Irish Lottery Winning Amounts

- Irish National Lottery Results Lotto

- Iowa Powerball Numbers For Last Night

- Irish.national-lottery.com › Irish-lotto › PrizesIrish Lotto Prizes & Odds Of Winning

- Www.lottoland.co.uk › Irish-lottery › ResultsIrish National Lottery Results • Winning Numbers • Check Your ...

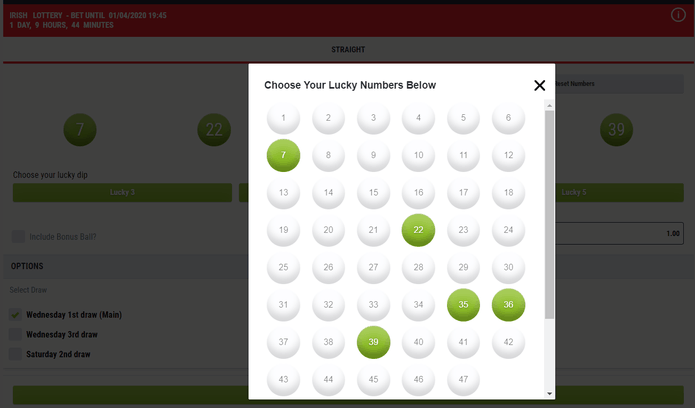

The odds of winning the national lottery are that of 1 in 45,057,474. This is 4.5x greater than the equivalent would be on that of the Irish Lottery. Just out of interest, let’s say that we reduced the number of balls that were needed for the jackpot in the Irish Lottery to that of 5, we would see our chances increase to that 1 in 1,533,939. Irish lottery draws can be observed live on television. It’s the most immediate way to see what the winning Irish Lottery Numbers are. To determine if you’ve managed to beat the Irish Lottery odds, you can rely on a couple of additional possibilities, as well. The odds of winning the Irish Lotto jackpot, by matching six numbers correctly from 47, currently stand at 1 in 10,737,573. This table shows the full breakdown of your chances of winning in each of the eight prize tiers offered in the main Lotto game: Number Matched. Odds of Winning. Winning Streak is an Irish television game show. Between 1990 and 2019, the show was broadcast weekly in Ireland, when five contestants would take part in a number of games to win cars, holidays, and cash prizes up to €500,000. The show was taken off-air in early 2020 amid the coronavirus pandemic. Sep 25, 2021 Irish Lotto Result for Saturday 25th September 2021. The Irish Lotto result for Saturday 25th September 2021 is shown below, along with the Plus Raffle code and the winning numbers for the Plus 1 & Plus 2 draws. The Lotto Plus Raffle has not yet been announced - check back soon!

MegaMillions mania is sweeping the nation. With the grand prize over $500 million, people are dreaming of what they would do with the money, and how they would share it with their families and friends. One one hand, the odds of winning – 1 in 175 million – are infinitesimal. But hey, someone has to win, and it might as well be you. There is however, one guaranteed winner in the lottery–the IRS. Not only are the lottery winnings taxable income to the winner, which will be taxed at a marginal rate of 35%, if the winner tries to share them with his family, there could be substantial gift taxes imposed also.

When someone wins the lottery, what is often done is their family will claim the prize through a partnership or other business entity that is comprised of family members. With a partnership the family could have varying interests. The theory is that the family all decided before the lottery to invest in the ticket together. Mom and Dad contributed 50 cents to the investment cost of the ticket, Uncle Bob contributed 25 cents, and Cousin Rita contributed 25 cents. The family will either claim that the partnership purchased the ticket, or the ticket is then contributed to a partnership in exchange for proportionate interests in the partnership.

Irish National Lottery Results Lotto

If this works, this helps to solve two significant tax issues -the income tax and the gift tax. Because of the marginal nature of the income tax, and because a partnership in itself does not pay taxes, but passes the taxes on to its partners, splitting the income among multiple partners saves on income taxes, because each individual partner has the opportunity to be taxed at the lower bracket rate before reaching their highest marginal rate. Of course, with a a jackpot this size, the difference might seem de minimis.

The other issue is the gift tax. As I’ve written about before, there is wealth transfer tax comprised of the gift tax and the estate tax. Each person can give away, during life or at death, a certain amount of property before the tax kicks in. Currently, that amount is about $5 million a person. Any property given away over that is taxed at the rate of 35%.

So by claiming the lottery winnings as a family partnership, a winner can claim that they are not making a taxable gift, because it was a family investment. This could save millions in gift taxes.

The problem is that in most cases, the IRS knows that it’s baloney. While it’s certainly possible to have agreements among family members (or friends, or co-workers) to enter into a lottery pool, the IRS will not look to kindly on post winning shams. If audited, they will ask for the partnership agreement that existed prior to ticket buying. They will ask when the family members contributed the money. They will ask your history of buying tickets as a family, etc.

Iowa Powerball Numbers For Last Night

Irish.national-lottery.com › Irish-lotto › PrizesIrish Lotto Prizes & Odds Of Winning

Lesson? If you are planning on sharing the lottery with other people, make sure that there is some sort of agreement beforehand.

Www.lottoland.co.uk › Irish-lottery › ResultsIrish National Lottery Results • Winning Numbers • Check Your ...

Or, take the winnings for yourself and flee to Tahiti.